Is a Payday Loan Threatening Jail?

Threats to throw you in jail for not paying a payday or short term loan are illegal and violate the Fair Debt Collections Practices Act (FDCPA) and the Texas Debt Collection Act (TDCA). Debt collectors are not allowed to threaten criminal acts for not paying back a debt. It is not a criminal offense for failure to back a payday loan.

The Problem a lot of times is that you gave them a check

The Debt collector scares you because you may have given the payday loan company a personal check. The collector claims that this is check fraud for bouncing a check or passing a hot check. The person on the line claims to be an “investigator” who tries to make it clear they he is not collecting a debt. Rather, he is trying to get information about a bad check.

Debt Collector claims hot check is a crime

The investigator on the phone tries to scare you by telling you the police are coming tomorrow to arrest you or that the sheriff is serving you with a criminal complaint. You know that a bounced check is a crime so you start to think this is true. It’s not. And the collector is only doing it to get you to pay it. Don’t be scared. There are things you can do.

How to handle this debt collector

The easiest thing to do is nothing. Tell the collector that you did not commit a crime. Do not try and settle. Do NOT give them access to your current bank accounts. Most of the time these collectors are scammers who purchased your information online illegally (that’s how they have your name, phone number and sometimes, even your social security number). These scammers are typically located in another country and hide behind fake phone numbers and fake legal-sounding company names. It’s all fake. Don’t fall for it. Hang up.

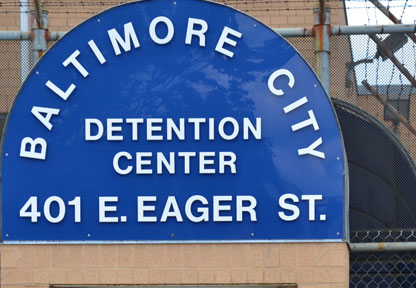

In Texas debt collectors do file criminal actions

The larger problem is that the legal system is so overburdened that SOME people do end up having criminal actions brought against them for passing a bad check. It is not legal, but it does happen because no one is policing the system. The good news (if there is any here) is that you will get due process. You will get a notice in the mail and you will be given an opportunity to resolve it.

As the article (and this one) says, it is ILLEGAL for them to bring bad check actions against you. When you get a payday loan you are giving them a post-dated check. The law prohibits theft charges when a post dated check is involved. The law does not allow the lender of a pay day loan threatening jail. This is because it is a hold check; it’s not the same as giving a check to the grocery store. In other words, it’s a LOAN.

The Problem is that some counties allow this to happen

In some small counties, the prosecutors and courts allow bad check charges to be filed. Fraud charges can be brought if the borrower closed the bank account right after getting the loan or never intended to pay it back in the first place. We understand that. But there needs to be SOME showing of fraud. Other than that, it’s a loan like any other. The whole business model of the payday loan industry is to give you a loan when you don’t have any money. So if you give the lender a check; they KNOW you don’t have the funds on hand. And their knowledge of that eliminates one of the elements of the crime.

What to do when Payday Loan Threatening Jail

If you are dealing with a collector on the phone just ignore them. More often than not the collector is trying to get the easy dollar by scaring you into paying and that is why the collector of the payday loan threatening jail. The collectors are just making idle threats against you. Don’t fall for that. You now know that payday lenders rarely bring criminal charges against anyone. You should not be worried if the collector refuses to divulge their real name, phone number and address. If you cannot verify it online, then it is probably a scam. Remember, if you haven’t broken a law, the payday lender cannot threaten jail or other criminal actions against you.

Should you have bad check charges brought against you, you need to act right away. Talk to the prosecutor’s office to see if it is aware that the complaint was filed by a payday lender. You may be able to get them to dismiss the case once they know its a payday lender.

Hire a lawyer to defend the complaint. The payday lender will have to prove its case to the Judge. At the hearing you will be allowed to introduce evidence that you did not commit fraud and you will force the payday lender to prove that you committed fraud. The attorney may even be able to get his or her fees paid for by the lender if you can show that the collection violated either the fair debt collection practices act or the Texas debt collection act. And you may be able to get the liability eliminated.

If you have a lot of other debts or even multiple payday loans, then you may want to consider filing bankruptcy to eliminate all of that debt. It can be overwhelming trying to juggle multiple payday loans and receiving threats from collectors. In bankruptcy, a creditor has the right to object to your debt being eliminated if you did in fact commit fraud. However, the lender would have to prove the fraud to he Court and on it’s face, a payday loan will never be considered fraudulent absent some other proof. We have NEVER had a payday lender object to any of our client’s discharge.

So if you hear the collector for the payday loan threatening jail, know that you CAN eliminate the debt in bankruptcy.

Please visit our website for more information about us and bankruptcy. Call us today at (713) 974-1151 to schedule a no-obligation consultation or feel free to email us at [email protected]

[paypal-donation]