Texas Writs of Garnishment to Collect Judgment Liens from Menard County, Texas

If you’re facing challenges in collecting a judgment in Menard County, Texas, Busby & Associates is here to offer effective solutions. Our skilled attorneys are experienced in defending, collecting, and enforcing judgments, with a primary focus on garnishing bank accounts and financial institutions. As experienced consumer bankruptcy, family law, and divorce lawyers, we extend our services to assist both obligors and obligees involved in child support lien cases. Additionally, we provide support for the domestication of foreign child support liens specific to Menard County, Texas. Contact us today for a consultation, and let us help you navigate the process of successfully collecting your judgment.

Texas Judgment liens in Menard County

A judgment lien, when properly affixed, functions as a lien on all nonexempt real property owned by the judgment debtor in Menard County. To establish this lien, it is necessary to accurately record and index an abstract of judgment. The abstract of judgment must be filed in each county where the judgment lien is sought to be fixed. The lien remains in effect for a period of ten years from the date of recordation and indexing, unless the judgment becomes dormant. It is important to note that the underlying judgment must be final and not interlocutory. However, an abstract can still be filed on a final judgment if the judgment is being appealed or a supersedeas bond has been filed. Furthermore, if a judgment creditor has taken the necessary steps to obtain a lien before the judgment is appealed, the fact of appeal will not nullify the effect of such steps in the event of affirmance. These rules specifically apply to judgments issued by Texas state trial courts and do not encompass the enforcement of judgments from other states and foreign jurisdictions. In the case of enforcing judgments from other states or foreign jurisdictions, the judgment must first be domesticated in Texas to create a lien, and subsequently, an abstract of judgment may be filed.

Texas Abstract of Judgment

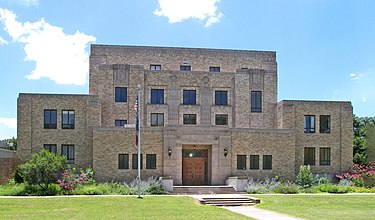

The preparation of the abstract of judgment in Texas is allowed by various parties, such as the judge, justice of the peace, clerk of the court, or the authorized representative of the judgment creditor, including their agent, attorney, or assignee. However, in small claims and justice courts, the judgment creditor is not permitted to prepare their own abstract. Additionally, abstracts of federal court judgments require the certification of the clerk of the court. To abstract your judgment lien in Menard County, Texas, you can visit the County Clerk’s office at 206 E San Saba Ave, Menard, Texas 76859.

Contents

Crafting a Texas abstract of judgment necessitates including specific details to adhere to legal requirements. These details consist of the names of the plaintiff and defendant, the defendant’s birthdate (if available to the clerk of justice), the last three digits of the defendant’s driver’s license and social security number (if accessible), the suit number in which the judgment was rendered, the defendant’s address or information about citation and the date and place of service if the address is absent in the suit, the date when the judgment was rendered, the awarded amount and the outstanding balance, any child support arrearage, the interest rate specified in the judgment, and the mailing address for each plaintiff or judgment creditor. Remember, failure to provide the mailing address may result in the imposition of a penalty filing fee. Additionally, the abstract of judgment must be verified by the creditor’s attorney, and unsworn declarations are not permissible.

Recordation of Judgment Liens Abstract

Menard County is where the abstract of judgment must be recorded if the debtor has real property in that jurisdiction. The abstract is submitted to the Menard County clerk, who is responsible for recording it in the county’s real property records, including an accurate notation of the date and time of recordation. Additionally, the clerk is mandated to incorporate the abstract into the alphabetical index to the real property records, indicating the names of both the plaintiff and defendant in the judgment, as well as the page number where the abstract is officially recorded.

Abstracts of Domesticated Judgment Liens.

The Uniform Enforcement of Foreign Judgments Act and the Uniform Foreign-Country Money Judgments Recognition Act grant foreign judgments the same enforceability as judgments filed in the originating court, enabling their enforcement in Texas. The foreign judgment holder must adhere to the lien requirements when seeking to domesticate the judgment.

Property To Which Lien Attaches Non-Exempt Real Property

The judgment lien covers all nonexempt real property owned by the defendant and located in Menard County, where it is registered.

Keeping the Judgment and Judgment Lien Alive

1. Non-governmental Judgments

A judgment lien retains its validity for a period of 10 years following the recording and indexing of an abstract. However, if the judgment becomes dormant, the lien is extinguished. Therefore, it is essential to (1) maintain the judgment’s active status and (2) obtain and record a new abstract of judgment. A judgment enters a dormant state if a writ of execution is not issued within 10 years of its rendering, but it can be revived through scire facias or by initiating an action of debt within two years of dormancy.

2. State or State Agency Judgments.

The enforceability of state or state agency judgments remains in effect and does not expire. A valid abstract of judgment establishes a lien that lasts for 20 years from the filing date, and the lien can be renewed for an additional 20 years by filing a renewed abstract of judgment, ensuring its longevity.

3. Political Subdivisions.

Under dormancy statutes, judgments of political subdivisions may become dormant; nevertheless, the revival statute (Civ. Prac. & Rem. Code § 31.006) clarifies that political subdivisions are not limited by the statute of limitations. Hence, judgments of political subdivisions can be revived at any time, extending beyond the two-year dormancy period.

4. Child Support Judgments.

- 34.001 Subsection (c) of the Civ. Prac. & Rem. Code provides an exclusion to the dormancy statute for judgments pertaining to child support, encompassing all such judgments, whether recently rendered or issued in the past.

Property Subject to and Exempt from Execution.

1. Property Subject to Execution.

The judgment debtor’s property is subject to levy by execution, provided it is not exempted by the constitution, statute, or any other rule of law. Typically, the following types of property are not exempt: a. Cash on hand or in checking or savings accounts; b. Pleasure boats and their motors and trailers; c. Collections such as stamps, coins, etc.; d. Stocks, bonds, notes, and other investments; e. f. Airplanes. Corporations have no protected property.

2. Property Exempt from Execution.

Whether it pertains to a family or a single adult, property falling within the following categories is exempt from execution: a) The homestead b) Personal property falling into specified statutory categories, up to a combined fair market value of $100,000.00 for families or $50,000.00 for single adults without family affiliation c) Current wages for personal service (excluding child support) and unpaid commissions, not exceeding twenty-five percent (25%) of the $50/$100,000 aggregate limitations d) Professionally prescribed health aids e) Worker’s compensation payments f) Cemetery lots held for sepulcher purposes g) Property that the judgment debtor sold, mortgaged, or conveyed in trust, provided the purchaser, mortgagee, or trustee identifies other property sufficient to satisfy the execution h) Assets held by the trustee of a spendthrift trust for the benefit of the judgment debtor i) Certain insurance benefits j) Designated savings plans, including retirement benefits and health savings plans k) College Savings Plans l) Certain consigned artwork.

WRITS OF GARNISHMENT.

When a judgment creditor needs to investigate whether a third party owes any funds or property to the judgment debtor, they can utilize the post-judgment garnishment process. If any debts are found, the creditor (garnishor) can obtain a garnishment judgment, compelling the third party (garnishee) to pay funds to the garnishor rather than the judgment debtor.

Requirements to Issue

After securing a judgment, garnishment becomes available if specific conditions are fulfilled. Firstly, the creditor must have a valid and subsisting judgment against the debtor, with the judgment being deemed final and subsisting from the date of rendition. Secondly, the debtor must not have filed an approved supersedeas bond to suspend execution on the judgment. Lastly, the creditor must assert that, to the best of their knowledge, the judgment debtor does not possess enough property subject to execution in Texas to satisfy the judgment.

Procedure for Securing Issuance Jurisdiction and parties

It is crucial to note that a post-judgment garnishment action is an independent legal proceeding, distinct from the main case it aims to enforce. The third-party garnishee should be named as the defendant, highlighting its involvement in an ancillary lawsuit. When filing for post-judgment garnishment, it should be done in the same court that rendered the judgment for collection, under a different cause number.

Service of the writ of garnishment/notice to judgment debtor.

To initiate the garnishment action, the garnishee must be served with the writ of garnishment. While the judgment defendant is not a necessary party to the garnishment action, they must be served with a copy of the writ of garnishment, the application, accompanying affidavits, and court orders as soon as practically feasible after the garnishee has been served. Additionally, it is required that the copy of the writ served to the defendant contains its contents in 12-point type and is presented in a manner intended to advise a reasonably attentive person. Failure to provide proper notice to the judgment debtor regarding the garnishment renders any judgment, except one dissolving the writ, null and void.

Banks as Garnishees for Writs of Garnishment

To ensure the delivery of garnishment writs to garnishee banks, it is necessary to direct them to the address designated as the registered agent of the financial institution in its registration statement filed with the Secretary of State pursuant to Section 201.102 or 201.103 of the Finance Code. Out-of-state financial institutions must complete the registration process with the Secretary of State, adhering to the state’s foreign corporation laws, which include designating an agent for process under Section 201.102. In contrast, Texas financial institutions have the choice to appoint an agent for process by submitting a statement to the Secretary of State under Section 201.103.

Officer’s Return.

The officer who carries out a writ of garnishment is required to provide a return that satisfies the citation regulations, as outlined in Tex. R. Civ. P. 663. It is advisable for the judgment creditor to carefully inspect the return before obtaining a garnishment judgment, especially if it is a default judgment. Returns in garnishment proceedings are governed by the same rules as other citations. Courts have deemed returns fatally defective if they fail to indicate the manner of service on a corporate garnishee or the place of service.

Forms for the form and Practical Procedure

If a bank account or other debt owed by the judgment debtor is identified as garnishable and it is determined to be cost-effective, file an Application for Garnishment supported by a signed affidavit from the judgment creditor’s attorney. The affidavit should contain crucial information, including the original suit and judgment details, the garnishee’s name, officers for service and address, and any available account names and numbers.

Collecting a judgment in Texas is made easier with Busby and Associates. Their contingency-based services allow you to proceed without upfront costs. Judgments from other states with a judgment debtor in Texas are reviewed individually, often involving a retainer. Moreover, in Menard County, they possess the necessary skills to help you garnish a bank account or financial institution, facilitating the recovery of the owed amount.