Texas Writs of Garnishment to Collect Judgment Liens in Archer County, Texas

If you are a judgment creditor who is having difficulty collecting from a debtor, let Busby & Associates help. We have extensive experience in all areas of judgments, including defense, collection, and enforcement. Our primary area of collections is garnishing bank accounts and financial institutions, but we also provide assistance for consumer bankruptcy, family law, and divorce cases, for both obligors and obligees under child support liens. Additionally, we can help with the domestication of foreign child support liens in Texas. Give us a call and we’ll help you navigate the process and take action to collect your judgment when the debtor lives in Archer County, Texas.

Texas Judgment liens

A judgment lien is established by properly recording and indexing an abstract of judgment in Archer County, which applies to all non-exempt real property of the judgment debtor within that county. The lien lasts for ten years, unless the judgment becomes dormant. To be eligible for a judgment lien, the underlying judgment must be final, not interlocutory. Even if the judgment is being appealed, steps can still be taken to establish a lien before the appeal. It’s crucial to remember that these rules only apply to Texas state trial court judgments and not to judgments from other states or foreign countries, which must first be domesticated in Texas before a lien can be established.

Texas Abstract of Judgment

In Texas, the task of creating an abstract of judgment can be handled by either a judge, justice of the peace, clerk of the court, or the agent, attorney, or assignee of the judgment creditor, with the exception of small claims and justice courts where the judgment creditor is not permitted to do so. Additionally, abstracts of federal court judgments must be certified by the court’s clerk.

Contents

An abstract of judgment in Texas must have the following information in order to be valid: (1) the names of the plaintiff and defendant; (2) the defendant’s birthdate, if known to the clerk of justice; (3) the final three digits of the defendant’s driver’s license number, if available; (4) the final three digits of the defendant’s social security number, if available; (5) the suit number in which the judgment was rendered; (6) the defendant’s address or, if not listed in the suit, the citation’s details and the date and location of service; (7) the date of judgment; (8) the amount of the judgment and the remaining balance; (9) any outstanding child support arrearage; (10) the interest rate specified in the judgment. It is also important to note that the abstract must include the mailing address for each plaintiff or judgment creditor, or a penalty fee will be imposed. Furthermore, the abstract prepared by the creditor’s attorney must be verified and unsworn declarations are not acceptable.

Recordation

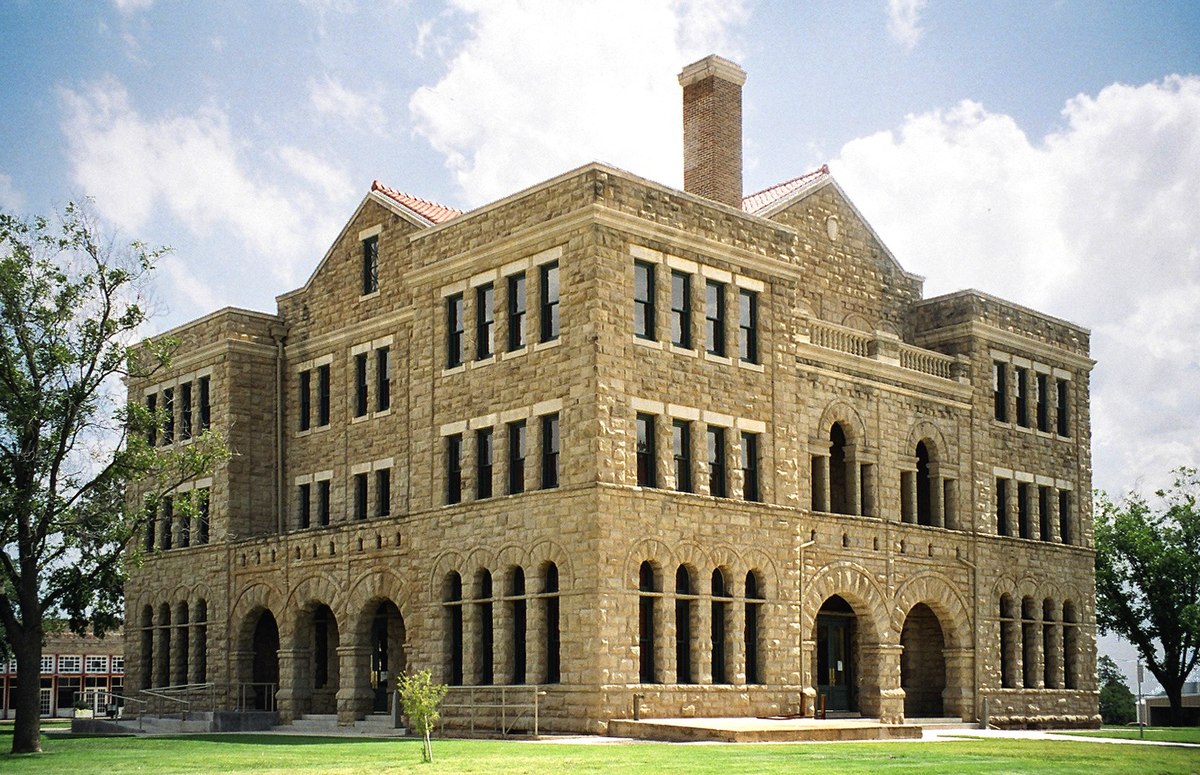

In Archer County; where the debtor possesses real property, the abstract of judgment must be recorded by the county clerk. The clerk must file it in the Archer County’s real property records and note the date and time of recordation. Furthermore, the clerk must include the names of the plaintiffs and defendants in the judgment and the page number in the records where the abstract is recorded in the alphabetical index of the real property records. In Archer County, Texas you would want to record the abstract of judgment at the County Clerk’s office located at 112 E. Walnut Archer City, Texas 76351.

Abstracts of Domesticated Judgments.

In accordance with the Uniform Enforcement of Foreign Judgments Act and the Uniform Foreign-Country Money Judgments Recognition Act, foreign judgments are enforceable in the same manner as if they were filed in the court where they were granted. This applies to the holder of the foreign judgment seeking to domesticate it in Texas, who must also comply with the lien requirements.

Property to Which Lien Attaches Non-Exempt Real Property

All of the defendant’s nonexempt real property located in Archer County; the county of recordation is subject to the judgment lien.

Keeping the Judgment and Judgment Lien Alive

- Non-governmental Judgments

The lien established by a judgment remains in effect for 10 years from the date of recording and indexing, unless the judgment becomes dormant. To keep the lien, one must take steps to both maintain the judgment and record a new abstract. If no writ of execution is issued within a decade of the judgment’s rendition, the judgment will become dormant. It can be reactivated through scire facias or by filing an action of debt before the second anniversary of the judgment becoming dormant.

- State or State Agency Judgments.

A state or state agency’s judgment remains valid and can be secured through a lien for a period of 20 years from the date of filing an abstract of judgment. This lien can be extended for an additional 20 years by filing a renewed abstract of judgment.

- Political Subdivisions.

As per the dormancy statutes, judgments made by political subdivisions may become inactive. Nevertheless, the revival statute in Civ. Prac. & Rem. Code § 31.006 does not impose any time restrictions on the revival of these judgments.

- Child Support Judgments.

According to § 34.001 of the Civ. Prac. & Rem. Code, child support judgments are exempt from the dormancy statute and apply to all child support judgments, regardless of when they were rendered.

Property Subject to and Exempt from Execution.

- Property Subject to Execution.

Unless protected by constitutional, statutory, or other legal exemptions, the property of the judgment debtor can be seized through execution. Typically, cash, pleasure boats, collections, financial instruments, and airplanes are not exempt from execution. Corporations, however, do not have any property that is considered exempt.

- Property Exempt from Execution.

Both families and single adults have certain property that is exempt from execution, including: the primary residence, personal possessions with a value of $100,000 for families or $50,000 for single adults as outlined by statute, current wages earned for personal services (excluding child support payments), unpaid commissions for personal services not exceeding 25% of the $50/$100,000 aggregate limit, health aids prescribed by a professional, worker’s compensation payments, cemetery plots for burial purposes, property that the debtor has sold, mortgaged, or transferred in trust if the buyer, mortgagee, or trustee can provide alternative property to satisfy the execution, assets held in a spendthrift trust for the benefit of the judgment debtor, certain insurance benefits, certain savings plans such as retirement benefits and health savings plans, college savings plans, and consigned artwork.

WRITS OF GARNISHMENT

The post-judgment garnishment procedure enables a judgment creditor to investigate any connections between the debtor and a third party for any funds or property owed to the debtor. If any such funds or assets are located, the creditor can then obtain a garnishment judgment, directing the third party to pay them to the creditor instead of the debtor.

Requirements to Issue

Garnishment can only be executed if the creditor has a valid and subsisting judgment against the debtor, the debtor has not filed an approved supersedeas bond to postpone the execution of the judgment, and the creditor has confirmed that, to the best of their knowledge, the debtor does not possess sufficient property in Texas that can be used to pay off the judgment.

Procedure for Securing Issuance Jurisdiction and parties

A post-judgment garnishment is a separate legal action from the main lawsuit it is meant to enforce. The garnishment action is ancillary to the main suit and should be brought against the third-party garnishee as the defendant. The application for post-judgment garnishment should be filed in the same court where the judgment was rendered, under a different cause number. For example, if the original suit was filed in the 245th judicial district court of Archer County, Texas, the garnishment action should also be filed in Archer County.

Service of the writ of garnishment/notice to judgment debtor.

The garnishee is the party that must receive the writ of garnishment, whereas the judgment defendant is not a mandatory party in the garnishment action. Nevertheless, they must be given a copy of the writ, the application, accompanying affidavits, and court orders as soon as possible after the garnishee has been served. Furthermore, the copy of the writ served to the defendant must include 12-point type and be written in a way that is easily understandable to a reasonably attentive person. If the judgment debtor is not given proper notice, any judgment, other than one dissolving the writ, will be void.

Banks as Garnishees

The registered agent’s address listed in the financial institution’s registration statement filed with the Secretary of State must be used when serving writs of garnishment on banks, as per Section 201.102 and 201.103 of the Finance Code. Out-of-state financial institutions must register with the Secretary of State and appoint an agent for the process, while Texas financial institutions may file a statement with the Secretary of State appointing an agent for the process.

Officer’s Return.

As outlined in Tex. R. Civ. P. 663, the officer responsible for carrying out a writ of garnishment must submit a return. It is crucial for the judgment creditor to examine the return before obtaining a garnishment judgment, particularly in cases of default judgment. The rules for citations also apply to returns in garnishment proceedings. In the past, defects in returns have been identified for failing to indicate the way in which a corporate garnishee was served and the location of service.

Forms for the form and Practical Procedure

In order to garnish a bank account or other debt, the location of the account must first be identified and it must be determined that there are enough funds to make the process cost-effective. To initiate the process, an Application for Garnishment must be filed, accompanied by a supporting affidavit. The affidavit, typically signed by the attorney for the judgment creditor, should include the following information: a. Information about the original suit and judgment, including credits applied to the judgment; b. The correct name and contact information for the garnishee and any officers who may be served; and c. Account names and numbers, if available.

Busby and Associates can assist in collecting your Texas judgment on a contingency basis, and can also help you garnish a bank account or financial institution within Archer County (the county of the judgment debtor). Judgments from other states where the debtor is located in Texas will be evaluated on a case-by-case basis, and may require a retainer.